Ben Gossack

Portfolio Manager, Fundamental Equities at TD Asset Management Inc.

How do we find an investment that provides income for today and growth for tomorrow? A differentiated TD ETF provides an all-in-one solution.

We all need income to fulfil our everyday needs. Canadians approaching retirement, or already retired, may require income beyond what their government and various pension plans provide. For many, that means drawing a regular income stream from their investments.

Income-bearing investments tend to be in fixed-income securities, such as bonds and GICs (guaranteed investment certificates), which are tied to interest rates. Lower interest rates over the past decade have made it harder to earn income through fixed-income securities. Even the slightest interest rate drop can trigger a major drop to one’s regular income stream.

Add to this scenario rising inflation and its effect on purchasing power. “Inflation is something investors haven’t had to worry about for the past decade, but it’s going to make this a more challenging period for fixed-income investing than it has been for the last 40 years,” says Ben Gossack, Vice President and Director, Portfolio Manager within the Fundamental Equity Team at TD Asset Management Inc. “Inflation is that silent hand that takes money out from under your mattress.”

Lower yields and inflation cause challenges to long-term investors

Investors need alternate ways to generate income

To offset lower yields and rising inflation, investors need to think about long-term growth. “Income is important, but so is having a growing income stream,” says Gossack. “One way to do that is to build up one’s nest egg, but that gets harder to do as you get older.”

The market offers numerous investment alternatives to help solve this income/growth dilemma, either through individual securities or mutual funds. However, there are often trade-offs. For example, high-dividend-yielding stocks, utility companies, and consumer staples provide income but not growth. Others, like growth stocks, provide growth but not a lot of income.

There are also many exchange traded funds (ETFs) designed for income or growth, but here too investors may need to compromise. “The income solutions the industry has provided through ETFs have typically been high-dividend-yielding stocks or covered call strategies, where you’re giving up future potential upside for income today” says Gossack.

TGED seeks to provide stable monthly income plus long-term growth

The TD Active Global Enhanced Dividend ETF (TGED) is designed to secure a stable monthly income with a focus on total return. Established in May 2019, this differentiated ETF invests primarily in dividend-paying equity securities in developed markets around the world, and in some emerging markets.

“Effectively we’re trying to provide individuals with a healthy income without sacrificing growth, so over the long run we’re aiming to give the investor a great total return, which includes a four percent yield in the meantime,” says Gossack.

The fund employs an active stock selection approach, seeking quality large cap companies that generate free cash flow, have strong balance sheets, and are poised to take advantage of multi-year secular growth trends. “We then build income streams on top of that through active call writing and put writing,” says Gossack.

Here’s where differentiation really comes into play. “A lot of ETFs in the market approach their covered call writing with a systematic philosophy,” explains Gossack. “As such, they roll their contracts on a monthly schedule and limit their upside to a few percentage points above the current price levels,” he says. The downside of this approach is that systematic covered call strategies are often proven to sacrifice growth for income and will lag the market on a total return basis.

“Our approach on the other hand is completely flexible,” says Gossack. “We are not forced to write any contract, so we write ours when we see the best opportunity from an active fundamental lens,” he says. While Gossack notes this approach is more complicated, it enables the fund to enhance its income from these option premiums and leave upside for stock prices to appreciate to capture growth. In addition, it is rare to find an ETF that writes puts in addition to covered call writing. “Put writing allows us to get paid to buy stocks we like at lower prices” says Gossack.

This three-pronged approach is designed to provide an all-in-one solution to investors looking for income and growth. “Not many income strategies have stocks that do not pay out dividends,” says Gossack. “That’s unique to us because we can convert these companies into synthetic dividend payers through our active call writing.”

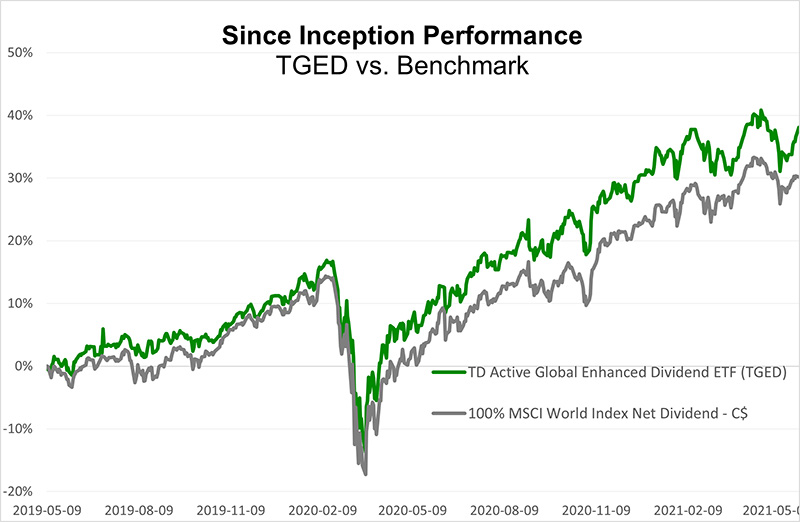

Despite the market turmoil and the COVID-19 pandemic sell-off, TGED has maintained its regular income target of four percent and achieved a 19.6 percent return for 2020.

The fund is available on the retail market to all investors. To learn more about TD ETFs, visit TD.com/ETFs. To hear more from Ben Gossack and for a deep dive on TGED, listen to our TDAM Talks ETFs Videocast: Income or Growth? Seek both with TGED.

The information contained herein has been provided by TD Asset Management Inc. and is for information purposes only. The information has been drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance.

Commissions, management fees and expenses all may be associated with investments in ETFs. Please read the prospectus and ETF Facts before investing. ETFs are not guaranteed, their values change frequently and past performance may not be repeated. ETF units are bought and sold at market price on a stock exchange and brokerage commissions will reduce returns.

TD ETFs are managed by TD Asset Management Inc., a wholly-owned subsidiary of The Toronto- Dominion Bank.

All trademarks are the property of their respective owners.

®The TD logo and other trademarks are the property of The Toronto-Dominion Bank or its subsidiaries.