What is Mortgage Default Insurance?

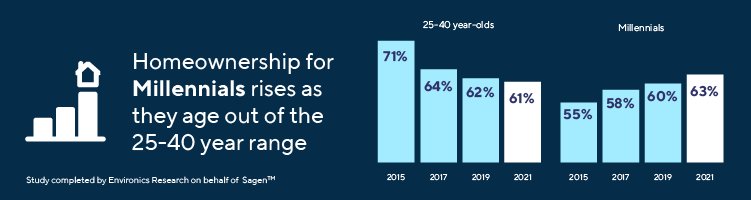

For most Canadians, one of the hardest things about buying a home – especially their first home – is saving the necessary down payment. Depending on the location where you’re looking to purchase, prices may be rising faster than the savings are building up. And, as values rise, the dream home can get further out of reach.

When looking to purchase your first home, the size of your down payment will help determine which mortgage option is best suited for you. Homebuyers have two basic options to consider: conventional mortgages, which require at least a 20 percent down payment; and high ratio mortgages, which require mortgage default insurance with down payments less than 20 percent.

“Mortgage insurance is what allows a large part of the population to access homeownership soon. At Sagen, we want to provide first-time homebuyers with the information they need to make good decisions and achieve their homeownership goals responsibly,” said Debbie McPherson, Senior Vice President, Sales and Marketing at Sagen™, Canada’s largest private mortgage insurance providers.

This is where mortgage default insurance can help by enabling qualified borrowers to purchase a home with as little as a five percent down payment. For example, if the right home for you has a purchase price of $800K, in a conventional mortgage situation a lender would normally require you to provide a down payment of at least $160K. With mortgage insurance, you can secure a mortgage with as little as $40K down.

Mortgage default insurance is a win-win situation for homebuyers and lenders. Under government regulations, it provides the purchaser with access to the housing market and protects the lender should the homeowner be unable to continue their payments. It should not be confused with ‘mortgage protection insurance’ which provides insurance protection for the homeowner, on the mortgage in the event of death.

Home is where it begins with Sagen’s tailored mortgage insurance products that make your first home purchase achievable much sooner based on your eligibility to qualify with a minimum of 5% down payment. Know your options and ask your mortgage professional what product is right for you.