Vincent Plante

Executive General Manager North American Copper Value Stream,

Glencore

Ajay Kochhar

Head of Battery Recycling,

Glencore

Canada’s critical minerals strategy hinges on the midstream. Glencore’s focus is to expand recycling and refining to keep more metals — and value — in Canada.

Canada is chasing big ambitions in critical minerals, and momentum is building nationwide. But while much public attention focuses on new mines and battery plants, the midstream — the smelters and refineries, and the recyclers that feed them, that transform ore and manufacturing scrap into usable metals — is just as vital.

How well Canada strengthens this part of the supply chain will determine how much value stays at home. That’s where Glencore — one of the world’s largest global diversified resource companies and a major player in Canada’s economy — sees a clear opportunity to bolster Canada’s critical minerals pipeline.

Glencore is one of the world’s largest diversified resource companies, producing and marketing more than 60 responsibly sourced commodities. With about 150 sites worldwide, its operations support supply chains across metals, minerals, and energy.

With recycling, you get traceability and a smaller footprint. Using refined scrap means starting with material that’s already been through the supply chain.

Global Scale, Local Impact

With nine mines and five processing facilities in Canada, employing about 12,000 people, Glencore is a pillar of Canada’s critical minerals economy. Its operations stretch from nickel mines in Sudbury and Raglan Mine to Quebec’s Horne Smelter, the only copper smelter still operating in the country. The company recently acquired Li-Cycle, now branded Glencore Battery Recycling, further adding lithium, nickel and cobalt recovery to its portfolio.

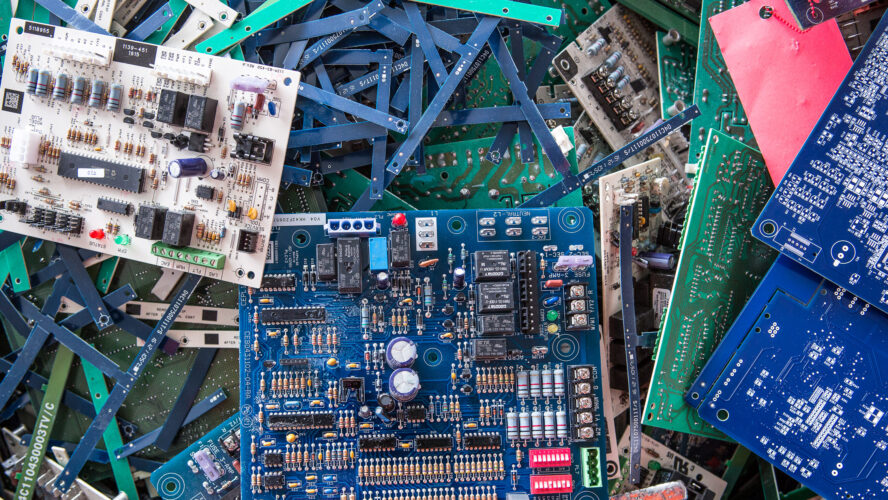

Glencore’s footprint is broad: it is Canada’s largest producer of refined copper, second-largest producer of nickel and zinc, and a leading producer of steelmaking coal. Its Canadian copper business alone contributed more than $850 million to the economy in 2023 and supported over 3,200 jobs. Recycling and circular practices are central to its growth strategy, from processing electronic scrap at Horne to closing the loop on battery metals.

Recycling and circular practices keep materials in circulation, rather than always starting from scratch. The company continuously invests in ways to recover more metals and return them to the supply chain.

Q&A: Inside Glencore’s Approach

Vincent Plante, Executive General Manager for Glencore’s North American Copper Value Stream, and Ajay Kochhar, Head of Glencore Battery Recycling, discuss how circular practices, policy support, and new capacity can shape Canada’s role in the critical minerals economy.

Recycling is central to your business. What does that look like in practice?

Vincent Plante: “Recycling has been part of our DNA since 1984, when we built the recycling circuit at the Horne Smelter, which is North America’s largest processor of electronic material. Back then, it was about keeping the smelter running after nearby mines closed. Today, it’s about meeting future demand. Copper demand is expected to more than double, and it’s already the third most used metal in the world.

These materials are everywhere: in cars, hospitals, data centres, and clean technologies. Producing them here, while continuing to invest in recycling streams, reduces reliance on new mining, lowers environmental impact, and invests directly in Canada’s future.”

Ajay Kochhar: “As for batteries, people often think battery recycling means only end-of-life batteries, but manufacturing scrap is just as important. In Ontario, two new gigafactories will generate material that needs to be recycled, and our feedstock, whether scrap or used batteries, is already highly refined. That lets us produce the same amount of metal with less processing and a smaller footprint, while keeping value in Canada.”

Federal and provincial support is critical. Midstream often gets overlooked, but it’s the link that turns mined or recycled material into refined metal. Long-term investment is essential to keep it viable.

The phrase ‘responsibly sourced’ gets thrown around a lot. Can you give concrete examples of what that looks like at Glencore?

VP: “At the Horne Smelter, our copper production has one of the lowest greenhouse gas profiles in the world. Since 2022, we’ve cut arsenic levels at the nearest monitoring station by nearly 47 per cent. Continuous improvement is part of our mission. We keep investing to raise environmental performance while expanding recycling.”

AK: “With recycling, you get traceability and a smaller footprint. Using refined scrap means starting with material that’s already been through the supply chain. You can make new units with less energy, less water, and fewer emissions than mining alone. That’s what responsible sourcing looks like in practice: looping materials back instead of starting from scratch.”

Looking ahead, what do you see as most important for Canada to succeed in this space?

VP: “Federal and provincial support is critical. Midstream often gets overlooked, but it’s the link that turns mined or recycled material into refined metal. Long-term investment is essential to keep it viable.”

AK: “It’s encouraging to see critical minerals recognized as strategic, even tied to national security. The challenge now is to turn that recognition into action by building the midstream capacity that lets Canada capture the value of its own resources and keep materials in circulation.”

Glencore has a deep and historic presence in Canada and decades of expertise in the circular economy. As the country builds its critical minerals strategy, the company is ready to support Canada’s economic growth, community infrastructure development, international trade and energy innovation for years to come. Learn more by visiting glencore.ca.